getalusk.ru News

News

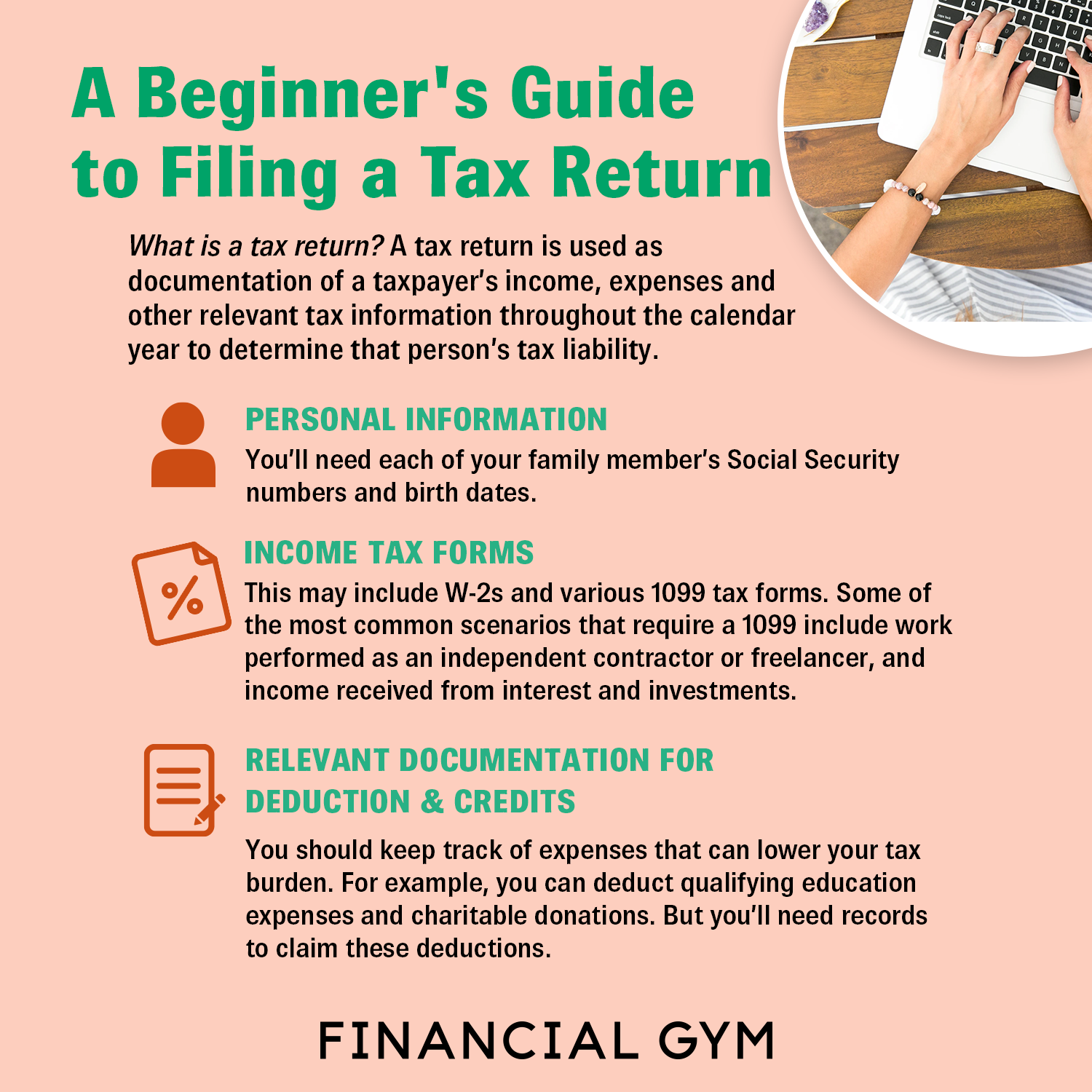

Learn How To File Your Own Taxes

Prepare and file your federal income tax return online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. Filing Taxes. Our experts bring you unbiased tax service reviews, answer your most pressing questions, and provide the latest tax news. Learn more about. Prepare and file your federal income tax return online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. Three ways to securely file your taxes this year ; TurboTax · On TurboTax's secure site · Costs may vary depending on the plan selected - click "Learn More" for. Online Taxes tax preparation service provides simple, fast and secure tax preparation software and online tax help for online filing of your income tax. TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. Enroll in H&R Block's virtual tax preparation course to master your return or start a career. With our comprehensive tax classes, courses, and training. Start for free and get the best tax refund with UFile, Canadian Tax Software Online, easy and fast. UFile tax software Canada - Your taxes, your way. How to become a tax preparer · 1. Create an IRS e-Services account on the IRS website. · 2. Complete and submit your application to become an authorized IRS e-. Prepare and file your federal income tax return online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. Filing Taxes. Our experts bring you unbiased tax service reviews, answer your most pressing questions, and provide the latest tax news. Learn more about. Prepare and file your federal income tax return online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. Three ways to securely file your taxes this year ; TurboTax · On TurboTax's secure site · Costs may vary depending on the plan selected - click "Learn More" for. Online Taxes tax preparation service provides simple, fast and secure tax preparation software and online tax help for online filing of your income tax. TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. Enroll in H&R Block's virtual tax preparation course to master your return or start a career. With our comprehensive tax classes, courses, and training. Start for free and get the best tax refund with UFile, Canadian Tax Software Online, easy and fast. UFile tax software Canada - Your taxes, your way. How to become a tax preparer · 1. Create an IRS e-Services account on the IRS website. · 2. Complete and submit your application to become an authorized IRS e-.

Follow these four easy steps and you can be preparing tax returns in a little as 10 weeks · Take Our Highly Rated Beginner Tax Preparation Course · Obtain a PTIN. Free File online offers federal tax preparation and electronic filing through the IRS for individuals with an adjusted gross income of $73, or less. Do it. Filing your own taxes online is easy and completely free (for both Federal and State taxes)! Use your smartphone, tablet or computer with a camera to safely. Easy, accurate online tax filing for less · online support · File when and where you want on desktop or mobile. · Starts your State return(s) using your Federal to. There are three primary ways to file your taxes: by mailing or electronically filing forms to the IRS, by filing with tax preparation software, or by seeking. You can prepare your taxes on your own, use online tax preparation software, or hire a professional tax preparer like a CPA. No matter which method you choose. Learn more about the three common ways to file taxes: e If you're a contracted employee or own a business, you'll have to keep tax records yourself. Why is filing taxes important? Residents living with low income or no income can access benefits through tax filing. Watch a video to learn more about how. What Do I Need to Know to File My Own Tax Return Online? · What sort of identification number and personal info do I need to file my taxes online? · Which. Gather all the annual tax documents you've received that record your taxable income and deductible expenses, most of which will arrive by the end of January. File My Own Taxes · Our most popular option · Self-file and get help when you need it · Fastest (takes most filers an hour or less). This may include: a credit check; a tax compliance check; a criminal background check; and a check for prior non-compliance with IRS e-file requirements. Once. Filing your taxes online can be beneficial for a few reasons. For one, you can complete the process relatively quickly and receive an almost immediate. Sign up for a Jackson Hewitt in-person or online tax preparation course & learn how to file taxes like a pro. Learn more. Everyone has to navigate the tax filing process at some point, but not all tax situations are the same. Learn about how to prepare and file taxes through. Are you a post-secondary student? Is yours a simple return? Are you filing a Federal tax return for the first time? Is your total family income under. % accurate calculations. Know your taxes are done right with our accurate calculations guarantee. Plus, get personalized guidance while filing with. AI-. There is no need for a certification to become an ERO – merely an Electronic Filing Identification Number. To learn more about the ERO, including how to. Filing your own taxes online is easy and completely free (for both Federal and State taxes)! Use your smartphone, tablet or computer with a camera to safely. There is an H&R Block income tax course offered each year. We'll tell you more about our tax preparation course as you read along. Plus, learn how you could.