getalusk.ru Market

Market

Where Can I Get A Cash Card

Apple Cash is the simple, secure way to spend with Apple Pay and send and receive money right in Messages or Wallet. Simplify your life with a Bank of America debit card. All you need is a Bank of America Advantage Banking account to get started. How to order a Cash App card - also known as Cash Card? · Open Cash App · Click the “Cash Card” tab · Click “Get Cash Card” · Click “Continue” · Follow the. Cash-to-Card Kiosks. Gillette Stadium is now a completely cashless stadium. Only contactless payment options will be accepted within the stadium. Event. How do I request to receive my benefits by debit card? · Debit cards are valid for three years. · If you previously had a debit card and it expired, is lost. The all-purpose Visa Prepaid card is a prepaid card that you can use to withdraw cash, pay bills or make purchases anywhere Visa Debit cards are accepted. We make it fast & convenient to bank your way. You've got options. One Reloadable Debit. Get 3% cash back at Walmart, up to $50 a year. See terms. See how. Yes, you can use it in-store. That's the reason of exists and why you can get both a physical card and the virtual card in Cash App. As long as. Discover the benefits of a Visa Prepaid card – simple, secure, and no credit check required. Learn how to get a prepaid card, a smart money management tool. Apple Cash is the simple, secure way to spend with Apple Pay and send and receive money right in Messages or Wallet. Simplify your life with a Bank of America debit card. All you need is a Bank of America Advantage Banking account to get started. How to order a Cash App card - also known as Cash Card? · Open Cash App · Click the “Cash Card” tab · Click “Get Cash Card” · Click “Continue” · Follow the. Cash-to-Card Kiosks. Gillette Stadium is now a completely cashless stadium. Only contactless payment options will be accepted within the stadium. Event. How do I request to receive my benefits by debit card? · Debit cards are valid for three years. · If you previously had a debit card and it expired, is lost. The all-purpose Visa Prepaid card is a prepaid card that you can use to withdraw cash, pay bills or make purchases anywhere Visa Debit cards are accepted. We make it fast & convenient to bank your way. You've got options. One Reloadable Debit. Get 3% cash back at Walmart, up to $50 a year. See terms. See how. Yes, you can use it in-store. That's the reason of exists and why you can get both a physical card and the virtual card in Cash App. As long as. Discover the benefits of a Visa Prepaid card – simple, secure, and no credit check required. Learn how to get a prepaid card, a smart money management tool.

Cash cards, which may include debit cards, gift cards, or payroll cards, are electronic payment cards that store cash for various types of payments. Earn up to $75 cash back every year on your Walmart purchases. Learn about the Walmart MoneyCard reloadable debit card account, click here! The all-purpose Visa Prepaid card is a prepaid card that you can use to withdraw cash, pay bills or make purchases anywhere Visa Debit cards are accepted. It's the debit card that helps you invest as you spend. Cash back at your favorite brands. Earn cash back when you spend on offers from participating brands. Use your reloadable debit card to shop, get cash at ATMs, pay bills online or shop in stores anywhere Visa, MasterCard or American Express cards are accepted. Our best cash back credit card. Earn unlimited 2% cash rewards on Visa purchases, a cash rewards bonus, and get 0% intro APR on this no annual fee credit. Get prepaid cash or reloadable gift cards for your Kentucky business with zero liability protection, spending alerts and transactions anywhere Mastercard®. Shop in store. Get cash back. The PayPal Debit Card1 lets you spend your PayPal balance anywhere Mastercard is accepted. Plus, earn points redeemable for cash. getalusk.ru: cash app gift card. With the Everyday Cash Card, you can manage your household expenses, travel within your budget and shop online–all while protecting your main household. Get the PayPal Debit Card to earn cash back on gas, groceries and more, spend your Paypal balance anywhere Mastercard debit card is accepted. Apple Cash is built right into iPhone, making it an easy way to send and receive money. 1 And because it's a digital card that lives in Wallet. WE DO NOT SHIP CASH CARDS. PLEASE SELECT "PICK UP AT CAMP" DURING CHECK OUT. If you're worried about your camper losing or misplacing cash, Camp WOW's Cash. Debit cards let you buy things without carrying cash. You can use your debit card in most stores to pay for something. You just swipe the card and enter your. Where Can I Load My Cash Card · Find your local Dollar General through its Store Locator. · Search for your nearest Family Dollar store via its Store Locator. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. The Generals Cash Card is the official identification card of Herkimer College. Issued to all students, faculty and staff, the Generals Cash Card is required. The True Link Visa Card Admins and Cardholders have unique options and log-ins. The Card Admin Manages the Visa card: loads funds, sets spending rules, and. Able to pay my friends and family quickly, I would say the only time I had a bad experience is when someone got my card and cashapp did not refund my money. A Cash to Card Kiosk is a self-service terminal that allows users to convert physical cash into digital currency or load funds onto a prepaid card. Users can.

How To Make More Money With 5000 Dollars

After paying off credit cards or other high interest debt, most smart investors put enough money in a savings product to cover an emergency, like sudden. As you most likely know, this is one of my favorite ways to create passive income. YouTube pays creators for ad clicks that are driven by the creator's videos. How can I invest $5, dollars for a quick return? The fastest way to make money is to trade volatile assets, such as cryptocurrency. But. Putting your money in a high-yield savings account is a great way to maximize your earnings and grow your money over time. But just how much can you earn. $5, daily is how much per year? If you make $5, per day, your Yearly salary would be $1,, This result is obtained by multiplying your base salary. If you already have a collection of high-end bags (lucky you!) or are willing to spend the time required to find good deals on them, you can make extra money by. 7 Proven Ways to Make $5,$9, Per Month in Passive Income · 1. Invest in Dividend Stocks · 2. Invest in Real Estate · 3. Earn Royalties from. To receive the cash bonus: 1) Customers must open and fund a new J.P. Morgan Self-Directed Investing account with new money of $5, or more by moving cash. It all starts with a choice · Monetize your skills · Selling physical products · Earn money with a blog · Make $5, a month online with. After paying off credit cards or other high interest debt, most smart investors put enough money in a savings product to cover an emergency, like sudden. As you most likely know, this is one of my favorite ways to create passive income. YouTube pays creators for ad clicks that are driven by the creator's videos. How can I invest $5, dollars for a quick return? The fastest way to make money is to trade volatile assets, such as cryptocurrency. But. Putting your money in a high-yield savings account is a great way to maximize your earnings and grow your money over time. But just how much can you earn. $5, daily is how much per year? If you make $5, per day, your Yearly salary would be $1,, This result is obtained by multiplying your base salary. If you already have a collection of high-end bags (lucky you!) or are willing to spend the time required to find good deals on them, you can make extra money by. 7 Proven Ways to Make $5,$9, Per Month in Passive Income · 1. Invest in Dividend Stocks · 2. Invest in Real Estate · 3. Earn Royalties from. To receive the cash bonus: 1) Customers must open and fund a new J.P. Morgan Self-Directed Investing account with new money of $5, or more by moving cash. It all starts with a choice · Monetize your skills · Selling physical products · Earn money with a blog · Make $5, a month online with.

starting with zero dollars, I found a faster and easier way to make money online. and this exact way pulls me in over $7, a month. in passive income. And. Just make sure to pick funds or ETFs without transaction costs. Paying $9 or more dollars on a $ transaction is very expensive. Consider using Scottrade to. Printable 5, Dollar Savings Challenge Tracker, Save 5, dollars in 1 year, Savings Goal, Money Challenge, Savings Challenge, digital Make sure to add. A campaign may not accept more than $ in cash Therefore, candidate committees should ensure they have enough cash on hand to make those refunds if needed. How To Make $ A Month: 13 Ways To Make More Money · Online Freelancing · Blogging · Virtual Assistant · Start An Amazon FBA Business · Selling Stock Photos. One of the most important ways to lessen the risk of losing money when you invest is to diversify your investments. It's common sense. — don't put all your eggs. Say you have a comfortable $5, extra. The first thing to do is run a financial health check. Paying off debt, building a rainy day fund, or starting a. It's not a bad idea to invest in the businesses providing passive income early. Then you will be able to earn money daily as you explore the rest of the game. A $1 million investment in a money market account could earn you $5, per year in interest income. Another great option you can explore is the Lyons. Saving helps you put money aside for important needs, whereas an investment strategy is designed to help you grow your savings and create income sources to fund. The apps that make saving the least painful are those that round up your purchases and other transactions to the nearest dollar and put aside the “savings. You don't need to wait to have thousands of dollars to start investing. Money matters — so make the most of it. Get expert tips, strategies, news. Revolut makes it easy. Convert money in 3 easy steps. 1. Start your exchange. Choose how much you want to convert. 2. Select your currencies. Click in the. The book is an experience and research-based material with which you can learn more about online money-making. Read more. Brief content visible, double tap. 7 Quick Ways to Make Money Investing $1, If you're shrewd, you can turn one thousand bucks into even more money. Here's how to make money on investments. earning potential and missing out on one of the best ways to build your health care savings for retirement. Turn HSA dollars sitting in cash into opportunity. In turn, the government agrees to pay that much money back later - plus additional money (interest). U. S. savings bonds are. Simple. Buy once. Earn interest. Putting your money in a high-yield savings account is a great way to maximize your earnings and grow your money over time. But just how much can you earn. And there's no state income tax, so your dollars will likely go further than in many other states.3 Even if housing eats up most of your $5, monthly. At the end of the day, the goal really is to just make sure you're saving some portion of your paycheck — even just $ By saving up a little each time you get.

Instant Mobile Banking App

Send Money With Zelle® · Access Zelle® inside Online Banking or through our Mobile App · Recipient may receive funds almost instantly · Send to almost anyone. Instant Balance lets you take a quick peek at your account balance(s) without logging in first. Instant Balance is available to view in your phone's widgets. Our mobile banking app lets you pay bills, make deposits, check balances, transfer funds, set up alerts from supported Apple® and Android® mobile phones. Speed, simplicity and convenience should be part of your banking routine! Download our mobile banking app to securely manage your money on-the-go. Access Instant Pay in Star One's Online or Mobile Banking under the Transfers & Pay option. Send funds 24/7 to anyone with an account at a financial institution. Mobile Banking provides you with instant and secure access Use the Planters Bank Mobile Banking app to quickly access your Online Banking information. Open a mobile banking account today. Free checking. No monthly, service, or ATM fees ever (save up to $ annually). Award-winning app. Live support. The Prosperity Mobile Banking app gives you instant access to your accounts anytime, anywhere. Check your account balance, pay bills, deposit checks 24/7. Download the Chime app for Mobile Check Deposit, online bill pay, and instant transfers2 with Pay Anyone. 1,,+ five star reviews. The #1 Most Loved. Send Money With Zelle® · Access Zelle® inside Online Banking or through our Mobile App · Recipient may receive funds almost instantly · Send to almost anyone. Instant Balance lets you take a quick peek at your account balance(s) without logging in first. Instant Balance is available to view in your phone's widgets. Our mobile banking app lets you pay bills, make deposits, check balances, transfer funds, set up alerts from supported Apple® and Android® mobile phones. Speed, simplicity and convenience should be part of your banking routine! Download our mobile banking app to securely manage your money on-the-go. Access Instant Pay in Star One's Online or Mobile Banking under the Transfers & Pay option. Send funds 24/7 to anyone with an account at a financial institution. Mobile Banking provides you with instant and secure access Use the Planters Bank Mobile Banking app to quickly access your Online Banking information. Open a mobile banking account today. Free checking. No monthly, service, or ATM fees ever (save up to $ annually). Award-winning app. Live support. The Prosperity Mobile Banking app gives you instant access to your accounts anytime, anywhere. Check your account balance, pay bills, deposit checks 24/7. Download the Chime app for Mobile Check Deposit, online bill pay, and instant transfers2 with Pay Anyone. 1,,+ five star reviews. The #1 Most Loved.

What is Instant Balance? Instant Balance is a feature on the mobile app that allows you to view your account balance without signing in. · How do I check the. See how easy it is to manage your money with our mobile banking app. It's like having your own personal branch right inside your pocket, 24/7. Farmers Bank & Trust Mobile Banking gives you immediate access to your account information 24 hours a day, 7 days a week. It's simple, safe, and secure. You. The Fifth Third Mobile App is like having your own personal branch right inside your pocket, 24/7. Check balances, transfer money, make a mobile deposit, and. Get up to $ in 5 min or less¹. Download the banking app designed to make finances easier—from taking ExtraCash™ advances to saving for your goals. Early access to direct deposit funds depends on payer. Pay friends: Chime's easy-to-use money transfer system can help you send money instantly to friends, much. The Fifth Third Mobile App is like having your own personal branch right inside your pocket, 24/7. Check balances, transfer money, make a mobile deposit, and. My Banking Direct is a service of Flagstar Bank N.A., so our customers use Flagstar Mobile Banking app to tap into the convenience of mobile banking.*. Instant. Instant Balance lets you take a quick peek at your account balance(s) without logging in first. Instant Balance is available to view in your phone's widgets. In between snapping selfies or pictures of the kids, you can check your Guaranty Bank accounts or utilize our instant mobile check deposit feature for free! All in one app. Varo. Online bank accounts with no minimum balance. Chime. Grow your savings automatically, like a boss. M1 Finance. Invest, borrow. These apps allow you to quickly cash checks by taking photos with your phone for deposit into bank accounts or prepaid cards. Key benefits are. With the TD Bank app you can deposit checks, pay bills, transfer money between your accounts, send money to friends, view your account activity and more. Sunflower Bank online and mobile banking allows you to access accounts and manage your finances from anywhere, anytime. Get the M&T Mobile Banking App for access to your handheld personal banking experience in a moment's notice. The convenience and comfort of community banking. HomeTrust's Mobile Banking allows you to access your personal checking, savings, & other accounts securely on the go at any hour of the day. Farmers Bank & Trust Mobile Banking gives you immediate access to your account information 24 hours a day, 7 days a week. It's simple, safe, and secure. You. For added convenience, use the Instant Balance feature to quickly check account balances without logging in. Under the “More” menu in the app, you can turn on. Download our Mobile Banking app and bank on your schedule. Icon of a paper Instant, touch-free payments with mobile wallet. Add your Flagstar Visa. Manage money 24/7. Check account balances and get instant account access on your phone from anywhere. · Adaptable to devices. Download to your Apple or Android.

Personal Loan For Home Remodel

A home improvement personal loan is a personal loan that a borrower uses for some type of home renovation project or emergency fix. Personal loans are a form of. Home improvement loans help you fund your home renovation projects. They're structured like traditional loans, so they don't require equity in your home. Home improvement personal loan details and benefits · APR as low as % · Amounts up to $50, · No collateral required · Credit considerations. We consider. A loan for home improvements can unlock potential in your property and provide the funding for desired upgrades. From installing a pool, to renovating your. A personal loan can cover any home remodeling or repair-related cost, whether you want to make a cosmetic update or need to make necessary or emergency repairs. Secured home improvement loan. Also known as a homeowner or home equity loan, this type of loan allows you to borrow a larger amount of money using the equity. Use a Rocket Loans home improvement loan for quick funding from $ - $ for your next project, no collateral needed. Apply today to see your rate. Pros: getalusk.ru interest rate than a personal loan. 2. Option to pay “principal and interest” each month (like a personal loan) or “Interest Only” payments. Finance your home improvement project with an unsecured personal loan from PNC. Borrow up to $35K with no collateral required. See rates and apply today. A home improvement personal loan is a personal loan that a borrower uses for some type of home renovation project or emergency fix. Personal loans are a form of. Home improvement loans help you fund your home renovation projects. They're structured like traditional loans, so they don't require equity in your home. Home improvement personal loan details and benefits · APR as low as % · Amounts up to $50, · No collateral required · Credit considerations. We consider. A loan for home improvements can unlock potential in your property and provide the funding for desired upgrades. From installing a pool, to renovating your. A personal loan can cover any home remodeling or repair-related cost, whether you want to make a cosmetic update or need to make necessary or emergency repairs. Secured home improvement loan. Also known as a homeowner or home equity loan, this type of loan allows you to borrow a larger amount of money using the equity. Use a Rocket Loans home improvement loan for quick funding from $ - $ for your next project, no collateral needed. Apply today to see your rate. Pros: getalusk.ru interest rate than a personal loan. 2. Option to pay “principal and interest” each month (like a personal loan) or “Interest Only” payments. Finance your home improvement project with an unsecured personal loan from PNC. Borrow up to $35K with no collateral required. See rates and apply today.

A personal loan for home improvement is straightforward. Once you have been approved, the loan amount is placed in your bank account, typically within a day or. Unsecured personal loans can be a good way to pay for home renovations if you have good credit, lack sufficient equity built in your home or just need to borrow. Are home equity loans a good idea for home improvements? A home equity loan can be used to make home improvements. Unlike a home improvement loan, a home equity. Learn more about unsecured home improvement personal loans from Wells Fargo. Rates start as low as %, get started on your application today. A personal loan can cover any home remodeling or repair-related cost, whether you want to make a cosmetic update or need to make necessary or emergency repairs. Our fixed APR ranges from % to %. Current U.S. Bank clients can choose a term from 12 months to 84 months to pay back the loan (maximum 60 months for. You do have options when it comes to financing, though, including home equity, refinancing, an FHA home improvement loan, a credit card, or a personal loan. Maximum APR for a LightStream loan is %. Loan terms range from 24 - months depending on the loan type. 1LightStream will offer a rate. How Do Home Improvement Loans Work? A personal loan for home improvement is straightforward. Once you have been approved, the loan amount is placed in your bank. If you need more than $K, you could consider other methods of financing like a home equity loan or HELOC, or you could try to obtain multiple personal loans. SoFi's home improvement loans range from $5K-$K and they're unsecured, which means that your house is not used as collateral to secure the loan. A home improvement loan is an unsecured personal loan taken out to finance home improvement or renovation. Home improvement loans through Prosper are a. Home improvement loans are personal loans that homeowners can use to pay for projects such as remodeling a kitchen, siding a house, adding a bathroom. Our online process makes it easy to apply for a home renovation loan. Fix a leaky roof, remodel your kitchen, or update your backyard—we're here to help. A home improvement loan typically refers to an unsecured personal loan used to pay for home upgrades—from remodeling or renovations to repairs and new. Personal Expense Loan A good choice when you need money quickly for smaller projects and emergencies, such as a new roof, upgraded plumbing or adding a room. Quickly unlock funds for remodeling, repairs, additions and other home improvement projects. Fast, easy application with low origination fees. Home Improvement Loans · FHA K Loans. Buying a home that needs remodeling and repairs? · Cash-Out Refinancing. Replace your existing mortgage with a larger one. A home improvement loan is a personal loan used to renovate, remodel, or improve your home. Home improvement loans can be used for minor or major projects. Personal loans can be a good option for smaller remodeling projects or homeowners with little equity in their property. These loans are typically unsecured.

Cryptocurrency Trading Canada

Bitbuy and Coinsquare are among the best crypto exchanges in Canada with the lowest fees. Learn more about the top Canadian crypto exchanges for beginners. 1. Bitbuy – Canada's Secure and Trusted Platform · 2. Kraken – Most Trusted Crypto Exchange in Canada · 3. Coinbase – Easiest Crypto Exchange Platform. Trade Bitcoin, Ethereum, and more on Ndax, Canada's top crypto platform. Enjoy secure, simple trading and asset management. OKX is a global crypto exchange ideal for crypto day traders, although US and Canadian investors can skip ahead, as the exchange isn't available in these. National Digital Asset Exchange (NDAX) is a multi-asset real-time automated trading platform for the emerging asset class of crypto assets Bitcoin and Ethereum. If you're new to futures, the courses below can help you quickly understand the Cryptocurrency market and start trading. CANADA, AFGHANISTAN, ALBANIA. In this guide, we'll break down the 9 best cryptocurrency exchanges in Canada based on factors like user experience, fees, and customer support. Buy and sell quickly and easily with Canada's most trusted crypto trading platform. CoinSmart takes the difficulty out of trading cryptocurrency. Start trading Bitcoin, Ethereum, Dogecoin, and over 50 other coins on Canada's first regulated crypto trading platform. Bitbuy and Coinsquare are among the best crypto exchanges in Canada with the lowest fees. Learn more about the top Canadian crypto exchanges for beginners. 1. Bitbuy – Canada's Secure and Trusted Platform · 2. Kraken – Most Trusted Crypto Exchange in Canada · 3. Coinbase – Easiest Crypto Exchange Platform. Trade Bitcoin, Ethereum, and more on Ndax, Canada's top crypto platform. Enjoy secure, simple trading and asset management. OKX is a global crypto exchange ideal for crypto day traders, although US and Canadian investors can skip ahead, as the exchange isn't available in these. National Digital Asset Exchange (NDAX) is a multi-asset real-time automated trading platform for the emerging asset class of crypto assets Bitcoin and Ethereum. If you're new to futures, the courses below can help you quickly understand the Cryptocurrency market and start trading. CANADA, AFGHANISTAN, ALBANIA. In this guide, we'll break down the 9 best cryptocurrency exchanges in Canada based on factors like user experience, fees, and customer support. Buy and sell quickly and easily with Canada's most trusted crypto trading platform. CoinSmart takes the difficulty out of trading cryptocurrency. Start trading Bitcoin, Ethereum, Dogecoin, and over 50 other coins on Canada's first regulated crypto trading platform.

We make crypto trading safe, easy, and affordable for Canadians. Buy Bitcoin, Ethereum and 60+ Cryptocurrencies with competitive pricing, Free cash in and. Coinbase is a secure online platform for buying, selling, transferring, and storing cryptocurrency. Although it isn't considered legal tender, Canadians are free to trade, purchase, and sell Bitcoin and other cryptocurrencies where it is accepted to do so. Get a crypto exchange for cash to cryptocurrency, Bitcoin near me in Vancouver. We offer our services in Edmonton, Victoria, and Calgary. The Best Crypto Exchanges of August · Kraken · getalusk.ru · Coinbase · KuCoin · Gemini · Bitfinex. Bitfinex. In Canada, Cryptocurrencies are legal to purchase but are not considered legal tender. The Investment Industry Regulatory Organization of Canada (IIROC). The Ontario Securities Commission (OSC) and the Investment Industry Regulatory Organization of Canada Canadian investors can also hold crypto ETFs in. Best Crypto Exchanges in Canada · Binance Canada · Bitbuy Canada · Coinbase Canada · Coinberry Canada · Kraken Canada · Gemini Canada. Gemini is a United States. Canada · Chile · China Offshore Bitcoin is the largest and most liquid cryptocurrency and represents over 50% of the $ trillion cryptocurrency market. Bitbuy is the best crypto exchange in Canada. This platform is excellent for Canadians looking for a reliable and secure cryptocurrency exchange. Depending on. Easy crypto trading for Canadians. · Competitive trading fees on 60+ coins · Trade securely on your platform of choice—iOS, Android, or your web browser. Trade. Trust. Coinbase is the safest place to buy, sell, and manage crypto. Canadian users can now add cash for free with Interac e-. Streamline Your Trading. With Netcoins, you have all the tools you need to stay in control of your crypto. Easily fund your account with Interac e-transfers. Check out at millions of online stores and crypto marketplaces, track market fluctuations in the app, or transfer your crypto into your PayPal Balance account3. Cryptocurrencies are not backed by a bank or authority like Canadian currency is. Additionally, cryptocurrency may not be subject to securities regulation which. How are airdrops and forks taxed in Canada? Crypto gifts and donations tax. Crypto mining tax Canada. Crypto staking Canada. Crypto margin trading, derivatives. getalusk.ru is a Canadian cryptocurrency exchange that helps you to buy and sell Bitcoin or Ether in seconds with Bank Wire, Interac e-Transfer, Visa or Mastercard. Best Crypto Trading Apps in Canada · Binance App Canada · Bitbuy App Canada · Coinberry App Canada · Coinbase App Canada · Gemini App Canada · Kraken App Canada. I came to learn recently that it's not possible to short crypto, not perform margins/futures trading on crypto. Buy Bitcoin In Canada: Recommended Canadian. Crypto Brokerage Trading & wallet infrastructure · Stablecoin and Payments Tokenization infrastructure. Paxos-Issued Assets. Lift Dollar (USDL) Yield-bearing.

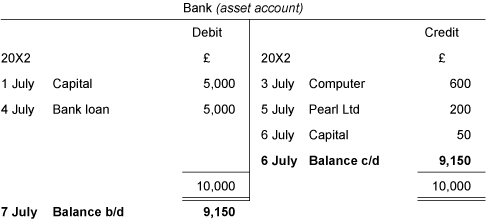

Balance Sheet T Accounts

Impact on the financial statements: Since both accounts in the entry are balance sheet accounts, you will see no effect on the income statement. Heading: Assets. Each side can now be added up, sub-totalled separately; • Increases and decreases can then be netted out in order to determine the balance in each account. This week you will learn the crucial process of 'balancing off' each T-account in order to record the correct figure for each account in the trial balance. T-Account - Free download as Word Doc .doc /.docx), PDF File .pdf), Text File .txt) or read online for free. The T account is a simple accounting tool. A T-account is an informal term for a set of financial records that uses double-entry bookkeeping. The balance of a T-Account is determined by the difference between the total debits and the total credits. T-Accounts are essential for understanding the flow. A T-account is a visual aid used to depict a general ledger account. The account title is written above the horizontal part of the “T”. A bank balance sheet, also known as T-Accounts, is a financial statement that shows the assets and liabilities of a bank at a specific point in time. I understand how "assets are referred to as the left side of the balance sheet (and accounting equation) and hence are on the left side of the T. Impact on the financial statements: Since both accounts in the entry are balance sheet accounts, you will see no effect on the income statement. Heading: Assets. Each side can now be added up, sub-totalled separately; • Increases and decreases can then be netted out in order to determine the balance in each account. This week you will learn the crucial process of 'balancing off' each T-account in order to record the correct figure for each account in the trial balance. T-Account - Free download as Word Doc .doc /.docx), PDF File .pdf), Text File .txt) or read online for free. The T account is a simple accounting tool. A T-account is an informal term for a set of financial records that uses double-entry bookkeeping. The balance of a T-Account is determined by the difference between the total debits and the total credits. T-Accounts are essential for understanding the flow. A T-account is a visual aid used to depict a general ledger account. The account title is written above the horizontal part of the “T”. A bank balance sheet, also known as T-Accounts, is a financial statement that shows the assets and liabilities of a bank at a specific point in time. I understand how "assets are referred to as the left side of the balance sheet (and accounting equation) and hence are on the left side of the T.

What is a T Account? A Visual Guide to Double Entry Accounting. A T account represents a general ledger accounts graphical representation. The account name is. A T-account is a very useful tool used in accounting to keep track of all the transactions that affected a certain account type. This graphic representation of a general ledger account is known as a T-account. A T-account is called a “T-account” because it looks like a “T,” as you can see. What are T Accounts? A t-account is a visual representation of a financial account for a financial accounting period. Each general ledger account will have. ▫ The balance sheet summarizes the balances of the asset, liability, and owner's equity accounts on a given date (usually the end of a month or year). It. The T Account is a visual representation of individual accounts in the form of a “T,” making it so that all additions and subtractions (debits and credits) to. Balance Sheet: Assets; Liabilities; Equity. Profit and Loss Statement (part of Equity). Revenue; Expenses. BS and P&L Visual Methid - T Accounts - Balance Sheet. Accountants and bookkeepers often use T-accounts as a visual aid to see the effect of a transaction or journal entry on the two (or more) accounts involved. To. The balance sheet displays the company's total assets and how the assets are financed, either through either debt or equity. T Account's first month of operations can be found below. Use this information to complete the T Accounts, Trial Balance, and Financial Statements that follow. The right side of the T-account is reserved for recording credit entries. Credits increase liability and equity accounts and decrease asset. The balance on an asset account is always a debit balance. The balance on a liability or capital account is always a credit balance. (Later on in this section. The simplest account structure is shaped like the letter T. The account title and account number appear above the T. Debits (abbreviated Dr.) always go on the. Prepare a balance sheet as of September 30, 20–. Page 3. T Accounts, Debits and Credits, Trial Balance, and Financial Statements. CHAPTER 2. Copyright. A company will use a Balance Sheet to summarize its financial position at a given point in time. It summarizes a company's assets, liabilities, and owners'. Purpose is to prove equality of debits and credits. • If the Trial Balance totals are not equal, the financial statements will not balance. • If the Trial. Use Journal Entries and ledger accounts instead. The increases and decreases in each asset, liability and equity item is tracked through its "T-account". A balance sheet is a financial statement showing assets, liabilities, and shareholders' equity (stockholders' equity or owners' equity) at a certain point in. In this guide, we'll be going through all the basics of T accounts, their uses in accounting, how to record them, and so much more. To better visualize debits and credits in various financial statement line items, T-Accounts are commonly used. Debits are presented on the left-hand side of.

How To Calculate Interest Payment

To find the interest due, multiply your daily periodic rate by the number of days in your billing cycle; therefore, 30 days x $ = $ in interest. Keep. Simple Interest Calculator - Use ClearTax simple interest calculator to calculate simple interest In simple interest, the payment applies to the. How to Calculate Interest Charges on Credit Cards The most widely used method credit card issuers use to calculate the monthly interest payment is the average. calculation – a monthly payment at a 5-year fixed interest rate of % amortized over 25 years. Don't worry, you can edit these later. Calculate. Mortgage. Select a fixed or floating interest rate. Fixed, Floating. Prime rate to be used for your calculations (%). Non-repayment period options. Start to repay your. Divide your interest rate by the number of monthly payments per year. · Multiply the monthly payment by the balance of your loan. · The amount you calculate is. Calculate the credit card interest you'll owe for a given balance and interest rate. Choose your monthly payment and learn the payoff time. Divide your interest rate by the number of payments in a year (12) to get your monthly interest rate: ÷ 12 = · Then, multiply this monthly. Figure out the monthly payments to pay off a credit card debt · =PMT(17%/12,2*12,) · Figure out monthly mortgage payments · =PMT(5%/12,30*12,) · Find out. To find the interest due, multiply your daily periodic rate by the number of days in your billing cycle; therefore, 30 days x $ = $ in interest. Keep. Simple Interest Calculator - Use ClearTax simple interest calculator to calculate simple interest In simple interest, the payment applies to the. How to Calculate Interest Charges on Credit Cards The most widely used method credit card issuers use to calculate the monthly interest payment is the average. calculation – a monthly payment at a 5-year fixed interest rate of % amortized over 25 years. Don't worry, you can edit these later. Calculate. Mortgage. Select a fixed or floating interest rate. Fixed, Floating. Prime rate to be used for your calculations (%). Non-repayment period options. Start to repay your. Divide your interest rate by the number of monthly payments per year. · Multiply the monthly payment by the balance of your loan. · The amount you calculate is. Calculate the credit card interest you'll owe for a given balance and interest rate. Choose your monthly payment and learn the payoff time. Divide your interest rate by the number of payments in a year (12) to get your monthly interest rate: ÷ 12 = · Then, multiply this monthly. Figure out the monthly payments to pay off a credit card debt · =PMT(17%/12,2*12,) · Figure out monthly mortgage payments · =PMT(5%/12,30*12,) · Find out.

This typically involves multiplying your loan balance by your interest rate and then dividing this amount by days (a regular year). This shows your daily. It is typically expressed as a percentage and is calculated by dividing the interest amount by the principal amount and then multiplying it by This formula. How do I calculate late payment interest? To calculate the interest due on a late payment, the amount of the debt should be multiplied by the number of days for. The initial balance plus the interest earned multiplied by time. Compound interest calculation example: If you have $1, with a 5% annual rate of interest . Key Takeaways · To calculate simple interest, multiply the principal by the interest rate and then multiply by the loan term. · Divide the principal by the months. In a principal + interest loan, the principal (original amount borrowed) is divided into equal monthly amounts, and the interest (fee charged for borrowing) is. Calculate the credit card interest you'll owe for a given balance and interest rate. Choose your monthly payment and learn the payoff time. Calculating Interest Rates · Interest equation: I P T = R {\displaystyle {\frac {I}{PT}}=R} {\frac {I}{PT}}=R · Plug in numbers: $ 2, $ 12, ∗ 12 m o. How to calculate annual interest rate · 1. Find the nominal interest rate and number of compound periods · 2. Apply the figures to the formula · 3. Raise the. If you are calculating simple interest, you will just need to use the formula I = Prt. If you are calculating compound interest, you will need to use the. Now that you found both your average daily balance and daily rate, you can calculate your interest charges. This can be done by multiplying your average daily. It is for this reason that the portion of your monthly payment allocated to interest may fluctuate. To calculate the interest due on your loan, please follow. Formula for Interest Calculator · 1. Simple Interest. The simple interest rate formula is as follows: A = P (1+rt) where,. A = Total repayment amount of the loan. Formula for Interest Calculator · 1. Simple Interest. The simple interest rate formula is as follows: A = P (1+rt) where,. A = Total repayment amount of the loan. Assess interest on each full day period from the date of the recovery demand letter. Payments are applied to accrued interest first, then to the principal. Therefore, a loan at 6%, with monthly payments and compounding simply requires using a rate of % per month (6%/12 = %). Unfortunately, mortgages are not. Figure out the monthly payments to pay off a credit card debt · =PMT(17%/12,2*12,) · Figure out monthly mortgage payments · =PMT(5%/12,30*12,) · Find out. Interest is accrued daily and charged as per the payment frequency. Rates used for calculations are not considered rate guarantees or offers. Calculations. If you are calculating simple interest, you will just need to use the formula I = Prt. If you are calculating compound interest, you will need to use the. Interest rate; Number of payments, and; Amount of money you need to borrow (the principal). To calculate any of these items, simply leave.

What Is The Best Way To Transfer Money To Someone

In most cases, I just opt for bank transfer. One client uses Deel as an intermediary, and that has worked quite well too. 1. Register or log in. Enter your information so that we can verify your identity. · 2. Select a receiver or send money to someone new. Tell us who you are. You may want to use a wire transfer if you're sending a large amount of money. Other options include paper checks and peer-to-peer payment apps like Venmo. The bank account number of the person you are sending money to. · The bank routing number (this is a nine-digit number that identifies the specific bank holding. Send and transfer money from the United States 24/7 using Western Union. Learn how to send money online, in person or through our international app. Convenient. Send money in the way that's easiest for you and your recipient, whether that's directly to their bank account or cash pick-up. This lets you easily send money to someone else's account, which makes it a great way to transfer money to a student away at school or someone you pay often. Generally, however, they're easy to use and are typically free, although there may be fees involved (say, to expedite the transfer of funds to a bank account. Send money to loved ones in the US with Western Union. We make sending money to United States bank accounts or for cash pickup easy. Learn more. In most cases, I just opt for bank transfer. One client uses Deel as an intermediary, and that has worked quite well too. 1. Register or log in. Enter your information so that we can verify your identity. · 2. Select a receiver or send money to someone new. Tell us who you are. You may want to use a wire transfer if you're sending a large amount of money. Other options include paper checks and peer-to-peer payment apps like Venmo. The bank account number of the person you are sending money to. · The bank routing number (this is a nine-digit number that identifies the specific bank holding. Send and transfer money from the United States 24/7 using Western Union. Learn how to send money online, in person or through our international app. Convenient. Send money in the way that's easiest for you and your recipient, whether that's directly to their bank account or cash pick-up. This lets you easily send money to someone else's account, which makes it a great way to transfer money to a student away at school or someone you pay often. Generally, however, they're easy to use and are typically free, although there may be fees involved (say, to expedite the transfer of funds to a bank account. Send money to loved ones in the US with Western Union. We make sending money to United States bank accounts or for cash pickup easy. Learn more.

Zelle is a fast and free way to send and receive money between two bank accounts. Most banks offer Zelle, which makes it possible to send money using someone's. Using money transfer apps, you can send money to someone else's bank account using the funds from your bank account, debit card, or credit card. You don't need. Use a money-transfer app. If you have the email or US mobile number of the recipient, you may be able to send money securely using an online service or app. What's the best way to transfer money to another person? · 1. Send money online · 2. Make a wire transfer · 3. Pay them in cash · 4. Make a Wise payment · 5. Write. You may want to use a wire transfer if you're sending a large amount of money. Other options include paper checks and peer-to-peer payment apps like Venmo. New apps like PayPal and Zelle make it easy to send money to friends and family in a matter of minutes, with no fees. Western Union and MoneyGram can be used. The money will be deposited into your recipient's bank account – like a bank deposit. Funds are typically deposited in minutes. Available only to US senders who. At getalusk.ru, it's easy and affordable to transfer money online. Save money. Live better. Interac e-Transfer. Send money anytime, anywhere in Canada. Visa Direct. The easy, secure way to send money, anywhere in the world What you'll need. It's easy to send money with Interac e-Transfer Easily send money to friends or family using Interac e-Transfer ® footnote section§. Money sent via Interac. When speed and simplicity are top priorities for a money transfer, wire transfers may be a good option. A wire transfer is a method of transmitting money. Whether you're looking for how to make bank-to-bank transfers between your own accounts or how to transfer money to someone else's bank account, wire transfers. Venmo makes sending money easy. Venmo is also what you get when you make paying for things a social event. The champion of peer-to-peer payments, Venmo lets you. Three simple ways to move your money to Canada · Wire transfer your money to Canada · Bring an international money order to Canada · Bring cash to Canada · How much. Paying someone for goods and services? Get Buyer Protection on eligible items Here's how to send money. It's easy as Use our Xoom service to transfer. A cashier's check is probably the safest way to transfer a large sum of money between two banks. It is also relatively fast and secure, so it. Whether a wire transfer or mobile app payment is better will vary depending on where your money is going, how much you're sending, and how quickly you need. You can easily transfer money person-to-person using 3rd party apps like Venmo, PayPal, Apple Cash and Cash App. All you need is RBC Cross-Border Banking. Zelle®: A fast and easy way to send money · There are no fees to send or receive money in our app · Money moves directly to their account in minutes · You only. You can transfer money between banks through your financial institution's website or app. · You may want to use a wire transfer if you're sending a large amount.

Brokerage Accounts That Pay Interest

A brokerage account. Uninvested cash from this type of account earns interest and is available for investing or managing expenses. Holding cash here is. The E*TRADE brokerage account offers a mix of investment choices, as well as research, guidance, information, trading tools, and on-call financial. How much interest is your broker paying you? IBKR clients can earn market rate interest on instantly available cash balances. TIAA Brokerage provides cash sweep product options that may accumulate and pay interest on the cash balance in your account. If any, interest accrues daily and. This term often refers to a corporation's distribution of funds (usually in the form of dividends, interest, and capital gains) as payment of current or past. The broker acts as a lender, and the borrowed funds allow for larger trades and more advanced trades, such as short-selling a stock. The investor pays interest. The Fidelity Cash Management Account is not a bank account. It is a brokerage account that allows you to spend, save, and invest. The account offers competitive. The TIAA Managed Sweep will generally pay a higher rate of interest than the TIAA Brokerage Sweep. Deposit accounts pay interest on deposits pursuant to the. Consider the Vanguard Cash Plus Account, money market funds, or brokered certificates of deposit (CDs) to save for your short-term goals. A brokerage account. Uninvested cash from this type of account earns interest and is available for investing or managing expenses. Holding cash here is. The E*TRADE brokerage account offers a mix of investment choices, as well as research, guidance, information, trading tools, and on-call financial. How much interest is your broker paying you? IBKR clients can earn market rate interest on instantly available cash balances. TIAA Brokerage provides cash sweep product options that may accumulate and pay interest on the cash balance in your account. If any, interest accrues daily and. This term often refers to a corporation's distribution of funds (usually in the form of dividends, interest, and capital gains) as payment of current or past. The broker acts as a lender, and the borrowed funds allow for larger trades and more advanced trades, such as short-selling a stock. The investor pays interest. The Fidelity Cash Management Account is not a bank account. It is a brokerage account that allows you to spend, save, and invest. The account offers competitive. The TIAA Managed Sweep will generally pay a higher rate of interest than the TIAA Brokerage Sweep. Deposit accounts pay interest on deposits pursuant to the. Consider the Vanguard Cash Plus Account, money market funds, or brokered certificates of deposit (CDs) to save for your short-term goals.

A brokerage account is a financial account that holds securities like stocks, ETFs, bonds and other assets on behalf of an investor. At Fidelity, any uninvested cash deposited in a Fidelity brokerage account is automatically put in a money market fund now earning %. Earn up to % on USD at Merrill Edge Earning interest on uninvested cash in a brokerage account is a useful, low-risk way to preserve the value of your. Similarly, a taxpayer's note that is given to a second party is only a promise to pay; it is not the equivalent of cash and, therefore, no interest deduction is. Consider the Vanguard Cash Plus Account, money market funds, or brokered certificates of deposit (CDs) to save for your short-term goals. “Unlike savings or checking accounts, which are your everyday bank accounts that pay a steady but small amount of interest, investment accounts can help you. Clients may earn interest on positive settled cash balances, i.e. uninvested cash in your account. The amount that you earn depends on the blended annual rate. The average of rates paid on interest bearing checking accounts at all Zero account minimums and zero account fees apply to retail brokerage accounts only. The brokerage firm uses the securities in your margin account as collateral for the money it lends to you to purchase these securities and you pay interest on. A Frost Brokerage account gives you: If you've received employee stock options as part of your compensation, Frost's Stock Option Exercise Program can offer. accounts at one or more banks. Deposit accounts pay interest on deposits pursuant to the terms and conditions in the disclosure document for the applicable. No, your Robinhood Cash Card and spending account are separate from your individual investment account. Although the spending account doesn't earn interest, our. I usually keep my saving in the same fund. Anything I don't need to pay my credit cards and mortgage. In brokerage retirement accounts, you generally pay a commission for agency These funds seek to pay higher returns than interest-bearing bank accounts. A dedicated account manager and access to a direct phone line · The ability to communicate with your account manager by email · Options for preferred interest. I'd like to earn 5%+ interest in the meantime. Besides Robinhood, is there another place where I can leave funds in the brokerage account (while waiting for an. Alternatively, opening a margin account will allow you to borrow money from the brokerage firm to buy securities and will require that you pay interest on that. brokerage accounts. Choice Select pricing is an alternative way to pay commissions on a per-trade basis for eligible equities and options transactions in a. The broker acts as a lender, and the borrowed funds allow for larger trades and more advanced trades, such as short-selling a stock. The investor pays interest. Best Brokerage Account Bonuses of September · Top Brokerage Account Bonuses of September · Citi: Up to $5, Most bonus offers are only available to.

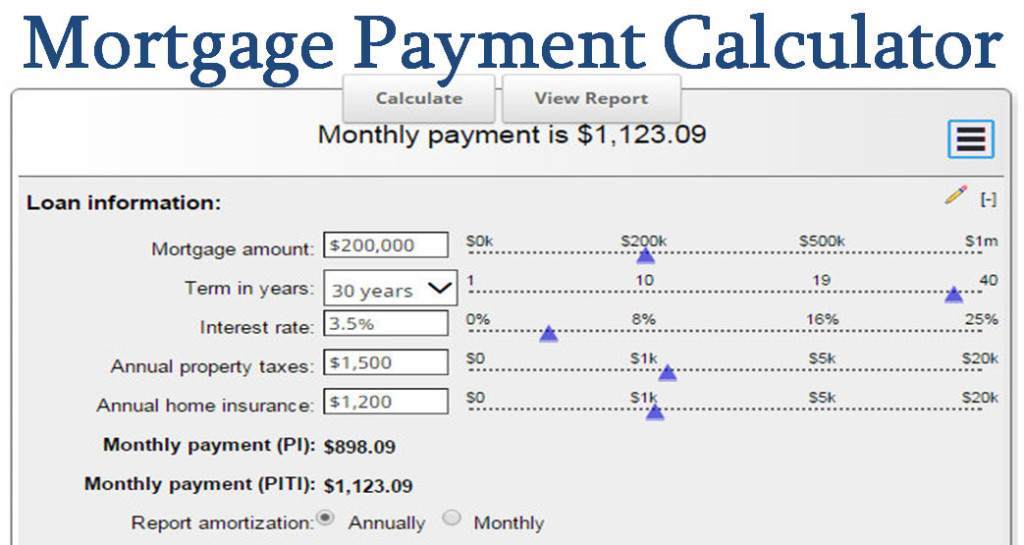

Mortgage Calculator With Downpayment

Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier, such as extra payments, bi-weekly payments, or paying back altogether. Mortgage Calculators. Our easy-to-use calculators will help you generate a mortgage estimate. View personalized scenarios to see what home loan may work best. Take the first step in buying your new home with our USAA mortgage payment calculator. View your estimated monthly mortgage payment and get preapproved. Guild's mortgage payment calculator can help you understand all of the costs in your monthly payment. Try our calculator to determine your total payment. This calculator determines how much your monthly payment will be for your mortgage. We take your inputs for home price, mortgage rate, loan term and downpayment. Mortgage Calculator: Monthly Payment. Find out how much your monthly mortgage payment could be, based on your home's purchase price and the terms of your loan. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier, such as extra payments, bi-weekly payments, or paying back altogether. Mortgage Calculators. Our easy-to-use calculators will help you generate a mortgage estimate. View personalized scenarios to see what home loan may work best. Take the first step in buying your new home with our USAA mortgage payment calculator. View your estimated monthly mortgage payment and get preapproved. Guild's mortgage payment calculator can help you understand all of the costs in your monthly payment. Try our calculator to determine your total payment. This calculator determines how much your monthly payment will be for your mortgage. We take your inputs for home price, mortgage rate, loan term and downpayment. Mortgage Calculator: Monthly Payment. Find out how much your monthly mortgage payment could be, based on your home's purchase price and the terms of your loan. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes.

Use the helpful getalusk.ru® mortgage calculator to estimate mortgage payments quickly and easily. View matching homes in your price range and see what you. This calculator will help you estimate a monthly payment, and understand the amount of interest you will pay regarding your home loan. Use our mortgage payment calculator to estimate your monthly mortgage payment. Select purchase or refinance option, input purchase price and down payment. Use our mortgage calculator to calculate monthly payment along with Taxes, Insurance, PMI, HOA & Extra Payments on your home mortgage loan in the U.S. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Adjust the loan details. Take your monthly mortgage payment and divide it by The resulting amount will be the extra payment that should go to your principal each month. In this. Take the first step in buying your new home with our USAA mortgage payment calculator. View your estimated monthly mortgage payment and get preapproved. Use our free mortgage calculator to easily estimate your monthly payment. See which type of mortgage is right for you and how much house you can afford. Our mortgage calculator can help you determine what your monthly mortgage may be. Use this calculator to figure out what you will pay each month for your. Use our mortgage payment calculator to estimate your monthly mortgage payment. Select purchase or refinance option, input purchase price and down payment. Use this mortgage calculator to calculate estimated monthly mortgage payments and rate options. Bank of America offers low down payment loans and programs to. Enter your home price, down payment, ZIP code and credit score into our calculator Footnote(Opens Overlay) to see which mortgage option may fit your needs. We'. A mortgage calculator that estimates monthly home loan payment, including taxes and insurance. Home affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Use this. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. Enter your monthly income or the mortgage payment you can afford, plus expenses and interest rate, to get your estimate. Adjust the loan term to see your. Use our mortgage calculator to calculate monthly payment along with Taxes, Insurance, PMI, HOA & Extra Payments on your home mortgage loan in the U.S. Estimate your monthly payments, what you might need for a down payment and mortgage insurance at closing using the calculator below. Use our free mortgage calculator to get an estimate of your monthly mortgage payments, including principal and interest, taxes and insurance, PMI, and HOA. Take your monthly mortgage payment and divide it by The resulting amount will be the extra payment that should go to your principal each month. In this.